Beyond Account Numbers: How Privacy First Payments Are Reshaping Digital Finance in Africa

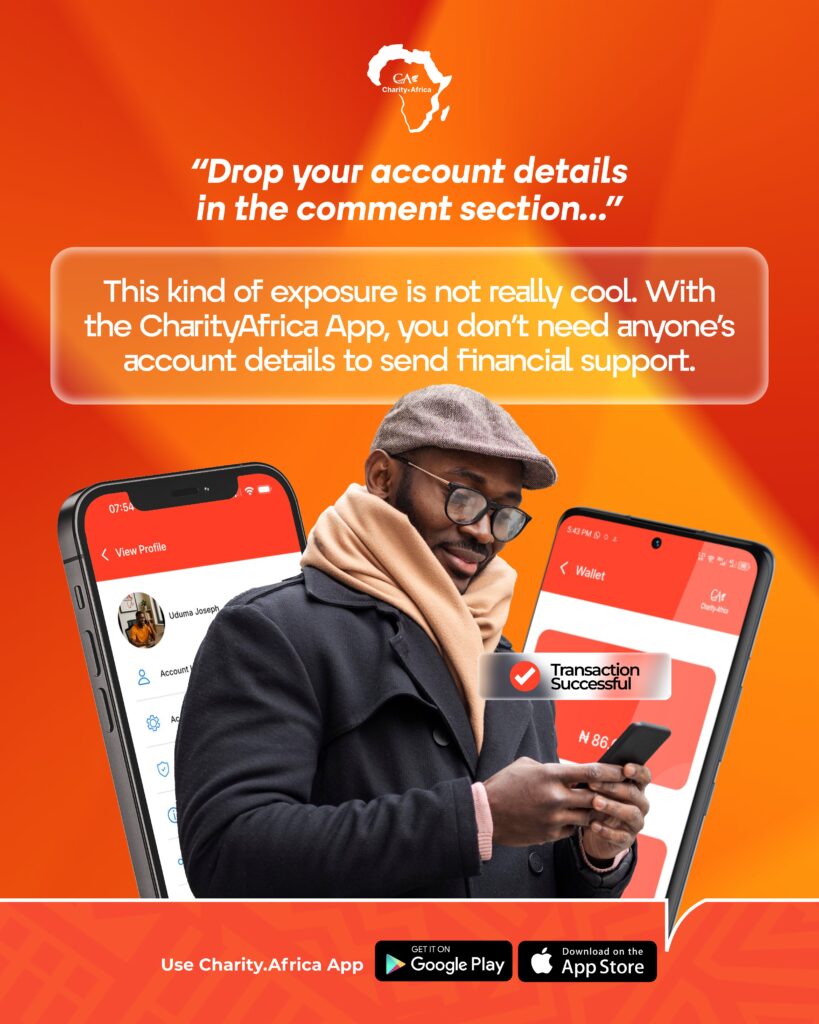

For many people across Africa, sending money still comes with an uncomfortable cost. Not the transaction fee, but the exposure that comes with it. Every transfer often requires sharing bank account numbers, full names, and personal details that users would rather keep private.

In a continent where digital trust is still being built, privacy is not a luxury. It is a necessity. And yet, traditional payment systems were never designed with privacy at the center.

As digital finance continues to grow, a new question is emerging. Can money move without personal details being exchanged? The answer is yes. And this shift is quietly reshaping the future of payments across Africa.

The Problem With Account Number Based Payments

Account numbers were designed for banks, not people. They work well inside closed financial institutions but fail in everyday human interactions.

Each time someone wants to send money, they must first ask for details. This creates friction, delays, and risk. A single wrong digit can lead to failed or misdirected payments. In some cases, funds are lost entirely.

Beyond errors, there is also exposure. Sharing account details means sharing identity. In an era of scams and data misuse, many people are understandably cautious. Some avoid digital payments altogether because they do not feel safe revealing personal information.

Privacy is not about hiding wrongdoing. It is about control. People want to decide who knows what about them.

Privacy as the Missing Layer in African Fintech

African fintech has focused heavily on access and speed, but privacy has often been an afterthought. Yet privacy is deeply connected to trust, and trust is what determines adoption.

When users feel exposed, they hesitate. When they hesitate, systems fail to scale.

A privacy first payment system changes this dynamic by removing the need for sensitive information exchange. Instead of asking for bank details, users interact through secure identifiers that protect their identity while enabling seamless transactions.

This shift is subtle, but powerful.

Why Privacy First Payments Matter More in Africa

Africa has unique financial realities that make privacy even more important.

First, many people operate within informal economies. Income sources are not always documented, and financial discretion is essential. Public exposure of financial activity can lead to social pressure or unwanted attention.

Second, shared devices are common. Phones are often used by multiple family members. Privacy protecting systems help ensure that personal financial information is not easily accessed by others.

Third, trust in institutions varies. People are more likely to adopt systems that respect their autonomy and minimize data sharing.

Privacy first payments address these realities directly.

How Digital Finance Is Evolving Beyond Details

The next generation of payment systems is moving away from static information like account numbers. Instead, they rely on dynamic identifiers that can be generated, shared, and redeemed securely.

This evolution allows users to send money without knowing anything about the recipient beyond what is strictly necessary. No account numbers. No long forms. No exposure.

The result is faster transactions, fewer errors, and greater confidence.

This is where platforms like www.Charity.Africa come into the picture.

Where Charity.Africa Fits In

Charity.Africa was built around a simple idea. Money should move without forcing people to reveal themselves.

Instead of relying on traditional banking details, Charity.Africa enables users to send and receive funds through secure digital identifiers that can be shared via familiar channels like email or messaging platforms.

This approach removes multiple barriers at once. There is no need to exchange account numbers. There is no risk of incorrect details. There is no dependency on banking hours or branch access.

For users, the experience feels natural. If you can use everyday messaging tools, you can use Charity.Africa.

Privacy is not added later. It is embedded from the start.

Speed, Scale, and Simplicity Combined

Privacy first systems also unlock scale. Sending money to multiple recipients traditionally requires collecting individual details, verifying them, and processing transfers one by one.

With modern fintech platforms like Charity.Africa, a single action can distribute funds to many recipients instantly. This is especially important for families, groups, organizations, and businesses that manage frequent payouts.

Speed and privacy reinforce each other. When systems are simple, they move faster. When they move faster, people trust them more.

Reducing Exclusion Through Design

Privacy first payments also support broader financial inclusion goals.

People who lack formal bank accounts can still participate. Those in rural or underserved areas can receive funds without navigating complex banking processes. Elderly users and first time digital users are not overwhelmed by technical requirements.

By removing unnecessary steps, platforms like Charity.Africa reduce exclusion caused by complexity.

This directly supports development goals related to poverty reduction, inequality, and economic participation.

The Psychological Impact of Private Finance

One of the most overlooked aspects of financial inclusion is dignity. Being able to transact privately gives users confidence and independence.

No explanations required. No details requested. Just a simple exchange of value.

This psychological shift matters. When people feel respected by financial systems, they use them more often. And when usage increases, economic activity grows.

The Future of Payments in Africa

The future of digital finance in Africa will not be defined by who has the longest list of features. It will be defined by who removes the most friction.

Privacy first payments represent a move toward finance that adapts to human behavior instead of forcing people to adapt to systems.

Charity.Africa is part of this movement. By focusing on simplicity, privacy, and accessibility, it demonstrates what truly inclusive finance can look like.

Account numbers served their purpose in the past. But Africa is ready for something better.

Privacy first payments offer a path forward where money moves easily, safely, and without unnecessary exposure. They respect the realities of everyday life while unlocking new possibilities for growth and inclusion.

As platforms like Charity.Africa continue to evolve, they are not just changing how payments work. They are redefining what financial freedom means in the digital age.

Leave a Reply